As the high cost of living continues to bite for millions across the UK, many are looking for ways to bring household costs down.

Slowing inflation in January means that prices are now rising less quickly – a trend economists hope will continue over the coming months – but household bills remain a massive expense after consecutive rises in recent years.

Energy, water, broadband and council tax have all seen spikes since the Covid pandemic, and remain stubbornly high in 2026. At the same time, the number of households struggling with debt has reached record levels, according to recent analysis by Citizens Advice.

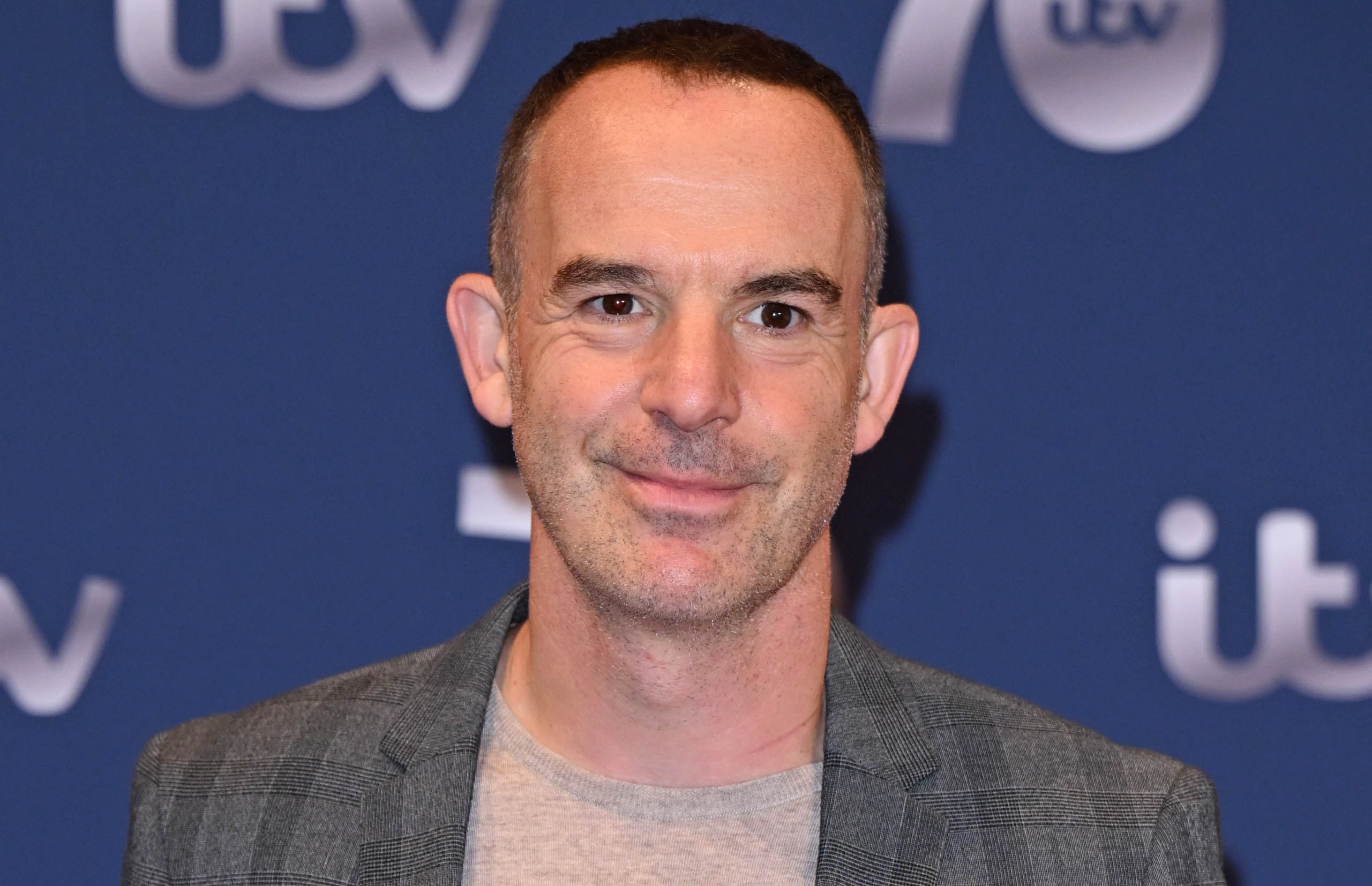

While these costs are essential, they can be brought down in many cases. Money expert Martin Lewis has encouraged bill payers to undertake a “money makeover” to quickly check where they might be overpaying – and how to get a better deal.

Writing on his Money Saving Expert website, Mr Lewis said: “Taking a day to cut your bills saves many people £1,000s over the year. And unless you earn £100,000s, doing a money makeover can be the next best way of putting some extra aside – something that’s really important during this cost of living crisis.

“So check your bills NOW and see if you can save £100s on broadband, mobiles, food and more by working through your finances one-by-one to ensure you’ve the best deal on everything.”

Here are six of the expert’s top tips:

Mobile contract

The cost of phone contracts can vary massively in the UK, meaning some may be paying as much as £200 more than others for a similar deal.

An estimated 14 million people across the country are now out of contract, meaning they can leave their provider at any point and in most of these cases, are paying far more than they need to be.

The quick way to find this out is to text “INFO” for free to 85075. Mobile providers must reply to this with information about the contract, including any early termination charge. If this is £0, then the contract has likely finished.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

For those who are happy with their mobile device, Sim-only deals can be found for as little as £4 a month.

One person told Money Saving Expert: “I took advantage of your deal with Lebara after disappointing service from my last provider. Saved £277 over the next year, get more data, better roaming, a month-by-month contract and keep my old phone number. Dead chuffed. Thanks.”

Subscription health check

Taking out a subscription is often a quick and easy process, so much so that they can become hard to keep track of.

More than a quarter of people (27 per cent) have had a payment taken that they thought they’d cancelled, recent data from Compare the Market found, ranging from streaming services to fitness apps.

The first step to track down unwanted subscriptions is for people to check the direct debit and standing orders on their bank account. Any regular outgoing that comes as a surprise should be tackled.

While these can be easily cancelled through the bank, it’s wise for bill payers to contact the company first. They may still be in contract, and so cancelling payment would be a breach.

There is a third form of payment called ‘Continuous Payment Authority’ which is less common and won’t show up in the same way as the other two. To be sure, savers can look through their statements to spot any unusual regular payment.

In the best cases, some companies may even refund customers who have mistakenly kept up a payment with them. One customer told Mr Lewis: “Found out that I was paying £10 for a second Netflix account. Contacted Netflix and they were very helpful, refunding me £70.”

Quick energy bill fix

Energy costs are one of the fastest rising expenses of the past five years, as the combined pressures of Covid, the war in Ukraine and the cost of living crisis forced rates up.

Ofgem’s energy price cap for January to April is now £1,758, lower than the peak of the pandemic, but remaining stubbornly higher than the rates seen in 2021.

The energy price cap is the maximum amount energy suppliers can charge for each unit of energy for those on a standard variable tariff. It is expressed as an annual bill for an average home.

To get ahead of the cap, many experts – including Ofgem itself – have recommended households consider a fixed-tariff energy deal. Savers can currently secure a fixed deal as much as 14 per cent lower than the price cap rate.

Broadband deals

As with mobile contracts, as many as seven million people are out of contract on their broadband and could be saving more elsewhere.

It’s worth shopping online for the best deal, with Mr Lewis estimating millions could “double the speed and halve the price” of their contracts for savings of up to £500 a year.

For those on lower incomes and certain means-tested benefits, there are also several companies offering social broadband tariffs for as little as £16 a month.

Cut council tax

Council tax is another cost that has seen major rises in recent years as many cash-strapped local authorities seek to recoup funds.

The locally charged levy is unavoidable, but many may not be aware that they can challenge the government on their property’s council tax band.

More than 43,000 people did this in 2024, and nearly 1,000 were able to lower their band by two places or more.

Analysis suggests around 400,000 households are in the wrong band and so could be paying too much council tax. If successful, a challenge could result in not just lower bills going forward, but also a backdated refund. One saver told Mr Lewis that they received a refund of £8,871 for an incorrect banding going back 28 years.

However, those interested should also be aware that bands can go up, as well as down. In the worst cases, a challenge has resulted in the Valuation Office Agency increasing the band for a whole street of houses.